Friguey Insurance: A Comprehensive Guide to Coverage and Benefits

In the realm of insurance, a myriad of options exist, each tailored to address specific needs and circumstances. Among these, Friguey Insurance stands out as a comprehensive and versatile solution, offering a wide range of coverage options and benefits. This article delves into the intricacies of Friguey Insurance, exploring its various facets, including its history, types of coverage, benefits, and considerations for potential policyholders.

A Glimpse into the History of Friguey Insurance

The origins of Friguey Insurance can be traced back to the early 20th century, when a group of visionary entrepreneurs recognized the growing need for comprehensive insurance coverage. Driven by a commitment to protect individuals and businesses from unforeseen financial losses, they established Friguey Insurance, laying the foundation for a company that would become synonymous with reliability and customer-centricity.

Over the years, Friguey Insurance has evolved and adapted to the ever-changing landscape of the insurance industry. By embracing innovation and staying attuned to the needs of its customers, the company has expanded its portfolio of products and services, solidifying its position as a leading provider of insurance solutions.

Exploring the Diverse Types of Coverage Offered by Friguey Insurance

Friguey Insurance offers a diverse range of coverage options, catering to the unique needs of individuals, families, and businesses. These include:

-

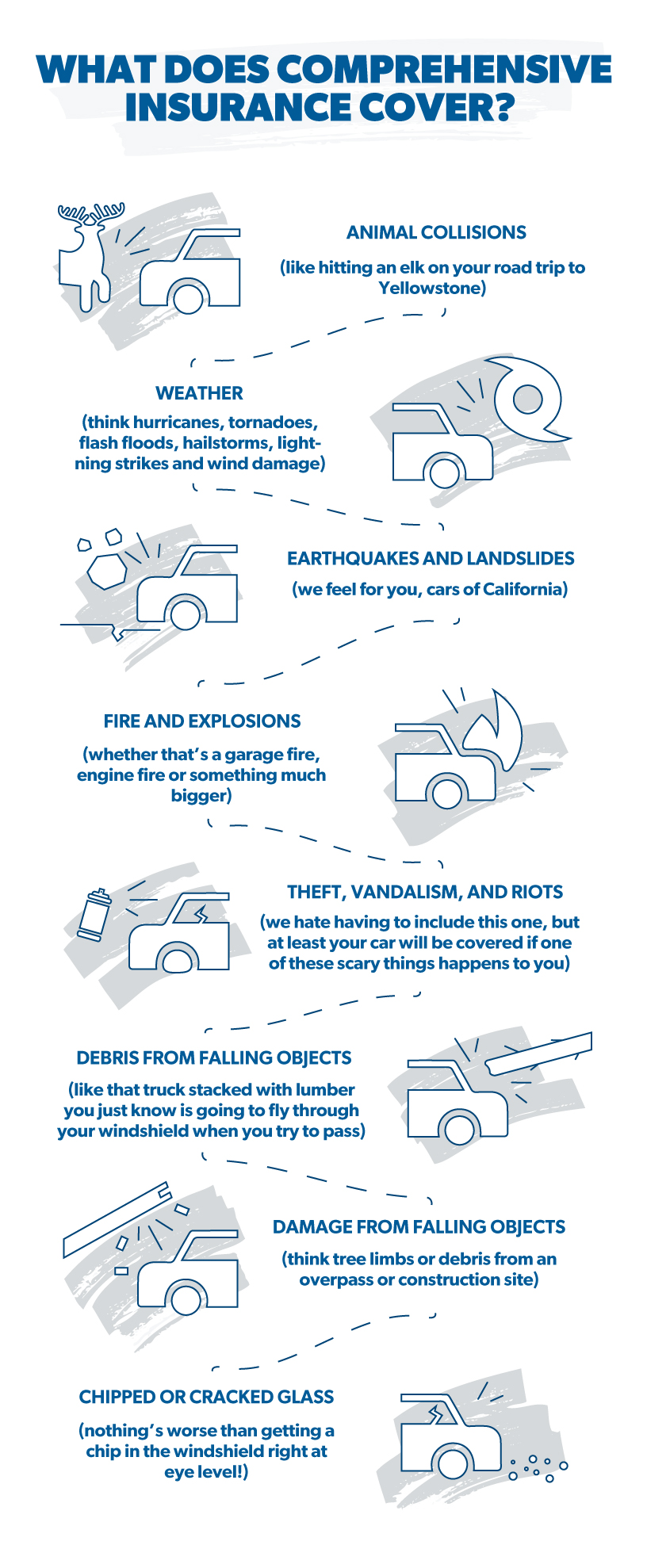

Auto Insurance: Friguey Auto Insurance provides financial protection against losses resulting from car accidents, theft, and other covered perils. Coverage options include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

-

Homeowners Insurance: Friguey Homeowners Insurance safeguards homeowners from financial losses arising from damage to their property, liability claims, and other covered events. Coverage options include dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

-

Life Insurance: Friguey Life Insurance provides financial security to beneficiaries upon the death of the insured. Coverage options include term life insurance, whole life insurance, and universal life insurance.

-

Health Insurance: Friguey Health Insurance helps individuals and families manage the costs of healthcare services. Coverage options include medical, dental, and vision insurance plans.

-

Business Insurance: Friguey Business Insurance protects businesses from a variety of risks, including property damage, liability claims, and business interruption. Coverage options include commercial property insurance, general liability insurance, workers’ compensation insurance, and professional liability insurance.

Unveiling the Benefits of Choosing Friguey Insurance

Friguey Insurance offers a multitude of benefits to its policyholders, including:

-

Comprehensive Coverage: Friguey Insurance provides comprehensive coverage options, ensuring that policyholders are adequately protected against a wide range of risks.

-

Competitive Rates: Friguey Insurance offers competitive rates, making insurance coverage accessible to a broad spectrum of individuals and businesses.

-

Exceptional Customer Service: Friguey Insurance is renowned for its exceptional customer service, providing prompt and courteous assistance to policyholders.

-

Financial Stability: Friguey Insurance boasts a strong financial foundation, ensuring that it can meet its obligations to policyholders.

-

Peace of Mind: Friguey Insurance provides peace of mind, knowing that you are protected from unforeseen financial losses.

Factors to Consider When Choosing a Friguey Insurance Policy

When selecting a Friguey Insurance policy, it is essential to consider several factors to ensure that the chosen policy aligns with your specific needs and circumstances. These factors include:

-

Coverage Needs: Assess your coverage needs based on your assets, liabilities, and potential risks.

-

Policy Limits: Determine the appropriate policy limits to adequately protect your assets.

-

Deductibles: Choose a deductible that you are comfortable paying out-of-pocket in the event of a claim.

-

Exclusions: Carefully review the policy exclusions to understand what is not covered.

-

Premiums: Compare premiums from different Friguey Insurance policies to find the best value for your money.

Navigating the Claims Process with Friguey Insurance

In the unfortunate event that you need to file a claim with Friguey Insurance, it is essential to understand the claims process. The claims process typically involves the following steps:

-

Report the Claim: Contact Friguey Insurance as soon as possible to report the claim.

-

Provide Information: Provide all necessary information about the incident, including the date, time, location, and description of the event.

-

Documentation: Gather and submit all relevant documentation, such as police reports, medical records, and repair estimates.

-

Investigation: Friguey Insurance will investigate the claim to determine its validity and coverage.

-

Settlement: If the claim is approved, Friguey Insurance will provide a settlement offer.

Tips for Maximizing Your Friguey Insurance Coverage

To maximize your Friguey Insurance coverage and minimize your premiums, consider the following tips:

-

Bundle Policies: Bundle multiple insurance policies with Friguey Insurance to receive discounts.

-

Increase Deductibles: Increase your deductibles to lower your premiums.

-

Maintain a Good Credit Score: Maintain a good credit score to qualify for lower insurance rates.

-

Shop Around: Compare quotes from different insurance companies to find the best rates.

-

Review Your Policy Annually: Review your policy annually to ensure that it still meets your needs.

Friguey Insurance: A Commitment to Community Involvement

Beyond its commitment to providing exceptional insurance coverage, Friguey Insurance is also deeply involved in the communities it serves. The company actively supports local charities, sponsors community events, and encourages its employees to volunteer their time and talents. Friguey Insurance believes that by giving back to the community, it can contribute to a brighter future for all.

The Future of Friguey Insurance

As the insurance industry continues to evolve, Friguey Insurance remains committed to innovation and customer-centricity. The company is constantly exploring new technologies and strategies to enhance its products and services, making insurance more accessible and affordable for everyone. With its unwavering dedication to its customers and its commitment to community involvement, Friguey Insurance is poised to remain a leader in the insurance industry for years to come.

Conclusion

Friguey Insurance stands as a beacon of reliability and customer-centricity in the insurance landscape. With its diverse range of coverage options, competitive rates, exceptional customer service, and unwavering commitment to community involvement, Friguey Insurance provides individuals, families, and businesses with the peace of mind they deserve. By understanding the intricacies of Friguey Insurance and carefully considering their coverage needs, potential policyholders can make informed decisions and secure the financial protection they need to navigate life’s uncertainties.